The digital transformation revolution has changed the dynamics of how businesses operate. This revolution necessitated the banking, financial services, and insurance industries to alter their business strategies to drive digital transformation. Automation has taken center stage in this process. One such automation solution is Robotic Process Automation (RPA).

Benefits of RPA in Finance and Accounting

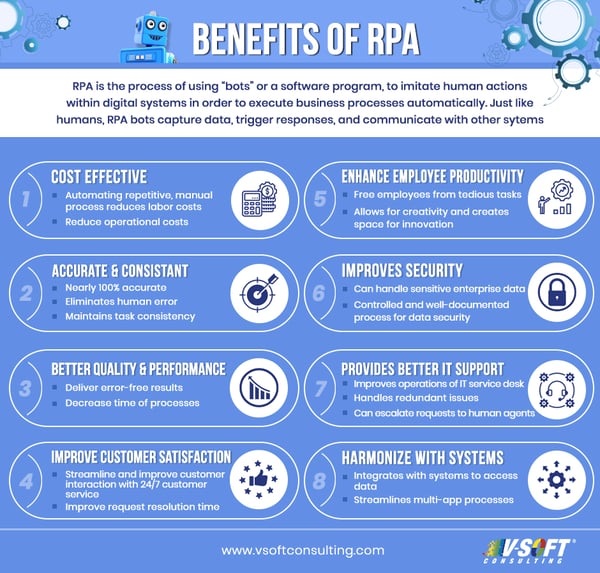

RPA is the fastest-growing automation solution with its innate automation ability to gather data and run applications, which usually are manually achieved. RPA is helping businesses automate tedious and repetitive tasks. Accounting and financial processes involve a large amount of data processing that is laborious and prone to human error, here is where organizations need automation to automate all these repetitive tasks with precision. RPA is the perfect solution to automate finance and accounting operations.

In the field of finance and accounting, RPA has significant applications. Let’s look at some of the applications of RPA in finance and accounting.

Automate Tasks

There are several tasks in the finance and accounting sector. Companies can identify the redundant tasks and use RPA software to automate them. With the help of smart chatbots, redundant tasks like financial data entry, and re-entry can be automated.

Data Entry and Validation

RPA can automate data entry operations by pulling essential information from a variety of sources, including bills, receipts, and financial statements. It can check the data's accuracy against specified rules, make appropriate adjustments, and flag deviations for human inspection.

Minimize Errors

Enterprises that have financial rule-based processes such as insurance and mortgage require robust, error-free automation. RPA bots can help perform search and comparison without causing errors. This can save companies a lot of time and money from making costly mistakes.

Document Automation and Standardization

RPA enables the standardization and maintenance of official documents, data, and customer records. This helps businesses keep confidential data safe and secure.

Compliance and Audit Support

RPA can assist in ensuring compliance with financial regulations by automating compliance checks and providing audit trials. It can validate data, detect questionable transactions, and provide reports for audit purposes.

Risk Management

RPA can help with risk management by automating risk assessment and monitoring activities. It can analyze financial data, identify potential dangers or irregularities, and produce reports for further study.

Vendor Management

RPA can automate vendor onboarding activities such as due diligence inspections, documentation, and contract administration. It can evaluate vendor information, amend records, and initiate approval and notification workflows.

Challenges with Legacy Financial Systems

Legacy finance and accounting systems are costing businesses big time. These systems are often more expensive than RPA solutions and create a negative employee experience. Here are the main tasks that become serious challenges when using legacy finance systems.

-

- Gathering, capturing, storing, and retrieving data in different data formats

- Deriving meaningful insights from data and processes

- Creating error-free and consistent results

- Creating, updating, and managing new customer accounts

- Keeping up with changing policies, and compliance procedures by location

- Adhering to rules without disrupting operations

- Transferring knowledge and training new hires quickly

- Mapping out a customer-centric business approach

- Resolving customer inquiries quickly and effectively

Finance and Accounting Functions RPA Automates

There are a number of manual and tedious tasks that can be automated by RPA. Some of these tasks may be more time-consuming than others and each business is different. Review the below table to understand the breadth in which RPA can automate finance and accounting tasks.

A Step-by-Step RPA Implementation Process for Finance and Accounting

-

- List out Processes to Automate: Develop a strategy by listing the processes to be automated. Then prioritize them based on metrics like complexity and ROI and ROV.

- Assess Feasibility: Evaluate to what extent the process can be automated. As a part of this, perform process examination and technical feasibility. Learn in detail how to conduct a feasibility assessment.

- Restructure Processes: Based on the feasibility assessment, try to identify, reoptimize, and restructure the processes.

- Create User Stories: The user story describes the features of an application to be built from an end-user perspective. Based on this data, develop a process definition document with defined RPA workflows for the development team.

- Develop Processes: The development process is carried out based on RPA workflows. Each RPA tool has unique capabilities, so choose the right tool based on business needs.

- Test RPA Processes: Carry out test cases in all possible scenarios and forward them to the development team to fix them.

- Reconfirm and Deploy: Reconfirm the results of the testing process and then deploy the complete RPA solution.

Conclusion

The future of RPA in finance, banking, and accounting is incredible. According to the Gartner Magic Quadrant for Robotic Process Automation, finance RPA solutions will drive innovation, scalability, operational efficiency, and compliance. As discussed in this article, from accounts reconciliation and statements generation to invoice processing, compliance management, and financial reporting, RPA in finance has a significant impact.V-Soft Consulting identifies your manual processes, documents your automation requirements, defines a results-driven RPA implementation strategy, and deploys the perfect RPA solution that derives maximum value.